Table of Content

In comparison, a policy with a $2,000 deductible costs almost $600 less — its average annual rate is $3,722. Liability coverage is the part of your home insurance policy that pays for medical or legal bills if you’re held liable for someone else’s injury or property damage. To make sure you are fully protected in case of a lawsuit, your liability coverage should be enough to cover the total value of your home, vehicles, and liquid assets.

Regardless, you need coverage to protect you against damage to your home that may be caused by things like hail. When summer storms come through Hanover, they sometimes deliver large hailstones that can do severe damage to your roof. If a hailstorm causes damage to your home, you can file a claim to have your insurance company cover the cost of repairs.

What does home insurance cover?

On average, the most expensive states for homeowners insurance in 2022 are Oklahoma, Nebraska and Kansas, while the least expensive states are Hawaii, Utah and Vermont. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Mariah Posey is an auto and homeowners insurance writer and editor for Bankrate.com. She aims to make the insurance journey as convenient as possible by keeping the reader at the forefront of her mind in her work.

MoneyGeek used data provided in partnership with Quadrant and collected home insurance quotes in Boston for homes with varying coverage levels to determine affordability. The baseline homeowner profile used was one with a 2,500-square-foot home built in 2000. It has a dwelling coverage of $750,000, a personal property coverage of $300,000 and liability coverage of $100,000. Comparisons were obtained using quotes for newly built homes, those with increased dwelling and personal property coverages, higher deductibles and homeowners with poor credit standing.

Top Home Insurance Agents Near Boston, MA

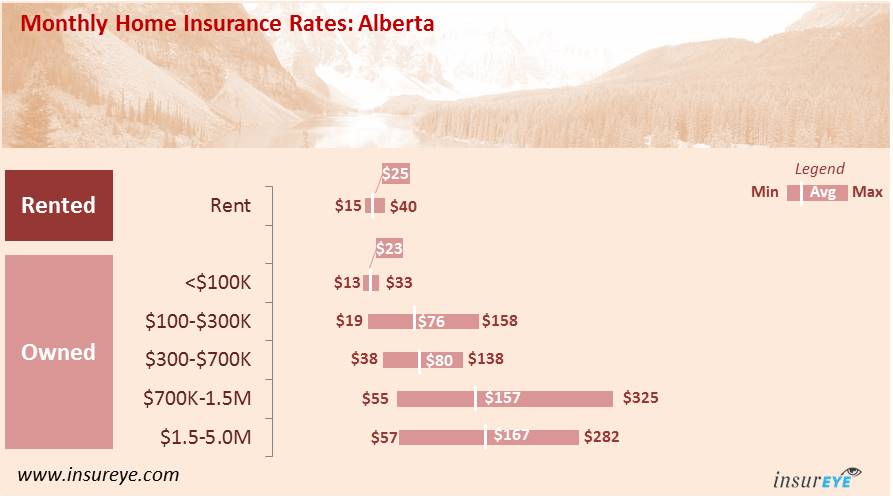

Most home insurance policies come with $100,000 in personal liability insurance but this is rarely enough coverage. The cost to defend a lawsuit or to pay for medical expenses for a serious injury can easily exceed that amount. Most experts recommend upping your limits to at least $300,000. On average, home insurance costs about $231 per month, but the price depends on the coverage level. At a dwelling coverage of $200,000, the average rate is $2,233, while a policy with $500,000 in dwelling coverage averages $3,594. If you decide to rent out your property, you’ll incur expenses related to being a landlord, such as repair and maintenance costs.

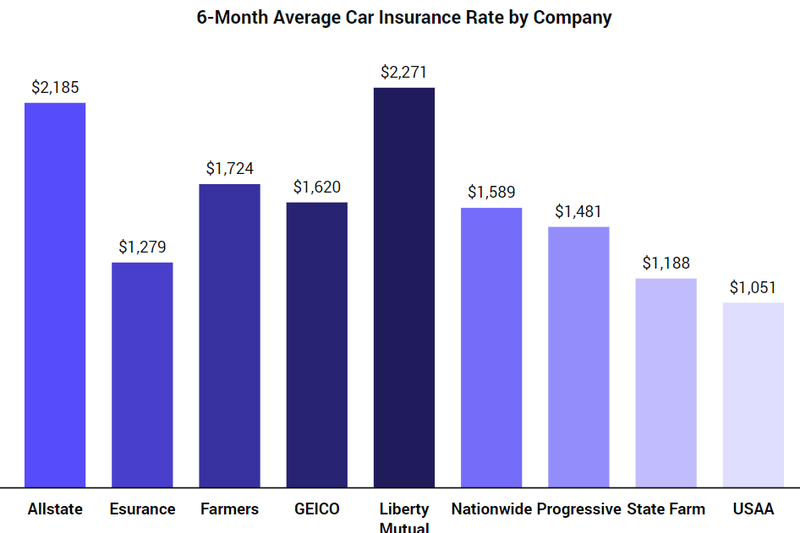

Although the use of credit scores isn’t illegal in Massachusetts, insurance regulators do not permit its use to determine how much homeowners insurance in Boston costs. It’s best to compare home insurance quotes in Boston before deciding where to make your purchase. Most insurers offer policies with the same core coverages, making the policy’s annual premium especially important. In this guide, we will explain everything from what coverage options are available to which companies have the cheapest rates for homeowners insurance in Boston. My home insurance company Liberty Mutual has good deductible for my policy, If offers the same coverage but for a lower cost.

Cheapest Home Insurance Companies in Boston if You Have a Lot of Personal Property

This means that if something happens, the cost of rebuilding would be higher in those areas, thereby leading to higher insurance premiums. Your insurance policy might not cover damage caused by floods or hurricanes. So, if you live in a flood-prone area, consider buying flood insurance coverage. Boston homeowners pay an average of $180.83 a month, based on our rate analysis.

It is also recommended as the best overall insurer for adults, seniors, smokers and young adults. In Boston, the cheapest average rates range from $10 per month for a $250K policy to $19 per month for the state-recommended coverage amount. Each homeowners insurance company sets its rates, which means that the average home insurance cost will vary from carrier to carrier even within the same state and ZIP code . Most mortgages are set up with an escrow account, which means that the mortgage company collects a portion of your home insurance premiums in your monthly payment. These amounts will be saved in your escrow account and the mortgage company will then pay your home insurance and property taxes when they come due. A more expensive home insurance policy will mean that your mortgage company needs to collect more money from you monthly, so your mortgage payment could be higher.

Home insurance companies calculate your premium based on your home’s rebuild value, ZIP code, claims history and more. If you’re on the hunt for cheap homeowners insurance, you may want to request quotes from multiple carriers, which will allow you to compare homeowners insurance rates. It can also be helpful to ask about the discounts you may qualify for to help lower your premium. Bankrate’s extensive home insurance research found USAA, Allstate and Travelers to be among the best home insurance companies in Massachusetts.

Houses in this area are valued lower than the state average, and this helps keep insurance costs in check. If we look at the car insurance rates trends in Boston, Massachusetts, it was on an upward swing from 2016 to 2019. The car insurance rates in Boston for adult and senior drivers are $1,916 and $1,637 per year respectively.

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. When buying homeowners insurance, you should get enough dwelling coverage to match the full replacement cost of your home. Compared to a home constructed in 2000, one built in 2015 or later is cheaper to insure.

MAPFRE Insurance and Arbella Insurance are also both below the average annual rate in Boston at $1,227 and $1,351, respectively. I'm not very familiar with other insurance companies policy offerings as I've only ever been insured through Progressive. Even if you already know what you want out of a company and policy, it’s still important to shop around to see who has the best homeowners insurance to suit your needs. Here are a few tips that will come in handy when you shop for homeowners insurance in Massachusetts.

Medical payments coverage pays for injuries to guests in your home, regardless of who is at fault. Medical payments differs from liability insurance in significant ways, primarily in that it is for minor incidents and comes in very low limits of $1,000 or $5,000. Choose the amount you want to pay out-of-pocket before insurance kicks in. Insurance companies deem certain dog breeds as liability risks due to the heightened chance of bites and attacks. Some insurers will raise rates to offset the risk involved with owning a dangerous dog, while others won’t cover you at all if you own one of these breeds.

No comments:

Post a Comment